How to Develop KPIs That More Than Count

By Andy Burrows

[First published 7th September 2017]

This article looks at how to go about developing Key Performance Indicators (KPIs).

If you’re interested in this topic enough to start reading, you’ll know that KPIs give you a richer view of performance than the normal accounting stuff that we produce in Finance. You’re also probably painfully aware that there are so many metrics to choose from. And that can make you wonder whether you’re looking at the right things.

So, the common question is, how can we develop the right KPIs?

But, before we get to that, I want to do through three things:

- Give a simple definition of a KPI

- Clear up a couple of misconceptions

- Take a stab at a description of what a good KPI is

That should head us in the right direction…

What are KPIs?

A simple definition of a Key Performance Indicator is that it’s just a specific way of seeing how well things are going with something. That sounds quite general, but I’ve started that way deliberately, so that we can hone it down as we go along.

Misconceptions about KPIs

As I was thinking about this, I realised that there are misconceptions about what constitutes a KPI. Thinking about these will help us to get to grips with what we’re trying to come up with when we develop KPIs.

Misconception 1 - KPIs have to be complex.

There is a tendency to think of KPIs as complex things, requiring IT integration, data downloads, calculations and so on, to come out with a number or a percentage.

But that’s not so. A Key Performance Indicator can be very simple. It can even be binary – on/off, yes/no, done/not done. Just think of your car dashboard as a set of KPIs for the way your car is running. You have your speedometer, which is taking driving data and converting into a speed reading that you understand – a complex KPI. If you’re driving a more modern car, it may have a trip computer that tells you how far you can travel on the amount of fuel you have left – a calculation based on different data sources. But then you also have indicators that show whether your lights are on or off, whether your parking brake is on, etc. And you have different coloured warning lights to say whether you have a minor or major problem.

So, bear that in mind. Normally, the simpler the better. And just because it’s simple, doesn’t mean it’s not important.

Misconception 2 - leading indicators forecast the future.

Now we’re jumping to a slightly more advanced concept – the concept of leading and lagging indicators. But since you may have heard of this, it’s worth making sure you don’t waste time worrying about the difference.

You may have heard that it’s best practice to have a mix of leading and lagging indicators – and that’s true. The misconception is that lagging indicators focus on past performance, and leading indicators look at the future.

The truth is that, at a basic level, all measures of performance look at the past – whether that’s a month ago or one second ago. Philosophically speaking, your performance in anything is always in the present, and by the time you report on it, it’s in the past. You can never report on future performance – unless you are some kind of soothsayer!

The difference between leading and lagging indicators is based on your standpoint relative to your ultimate goal. For example, if your ultimate goal is to have a high traffic website, then the number of website visitors will be a lagging indicator. But if your ultimate goal is to sell more stuff off your website, then website visitors will be a leading indicator (because you can’t sell stuff from your website if no one visits it). Kapeesh?

Some people talk about lagging indicators being output-focussed, and leading indicators being input-focussed. It’s kind of the same distinction, but I don’t think it quite captures the essence, for reasons I’ll come onto later.

What’s a good KPI?

So, what is a good KPI? Well, let’s start with the three words, in reverse order:

- Indicator – it must tell you something

- Performance – it must measure performance

- Key – it must relate to performance in something important to success

It’s the latter two that highlight problems. Consider, for example, a statistic that is regularly reported in monthly management reports all over the world – headcount. What performance does a headcount number indicate? What does it tell you about performance? Is it good to have more or less? Do we have more people because we have more work to do (possibly a good thing), or because we’re inefficient (a bad thing)?

Measure what matters.

And there’s a reason why we should measure what matters. You see, people naturally act on things that are measured. For example, you measure headcount – so what? You put a ‘plan’ number next to it, and managers think that automatically means you want them to hit that number. That drives behaviour – reduce headcount – even if it means that employees get stressed and go sick, and/or you get less of the most important work done. It may not be leading to the behaviour you want.

That leads to more aspects of good KPIs:

- Clear reference to an important objective for the organisation (whether that’s the business, the function, the department, team or individual) – these objectives are often called “critical success factors”.

- Clear what is good and bad performance – sometimes this means that when you report KPIs, they must come with a definition of good and bad performance.

- Clear what actions can influence the measures (and who is responsible for those actions) – the quicker the business can respond to an adverse KPI, the quicker you can steer into better performance.

- Simple to calculate and report accurately – many a bad decision has been made because of duff data.

Step 1 to develop KPIs – know the objectives

So, how can we develop good KPIs?

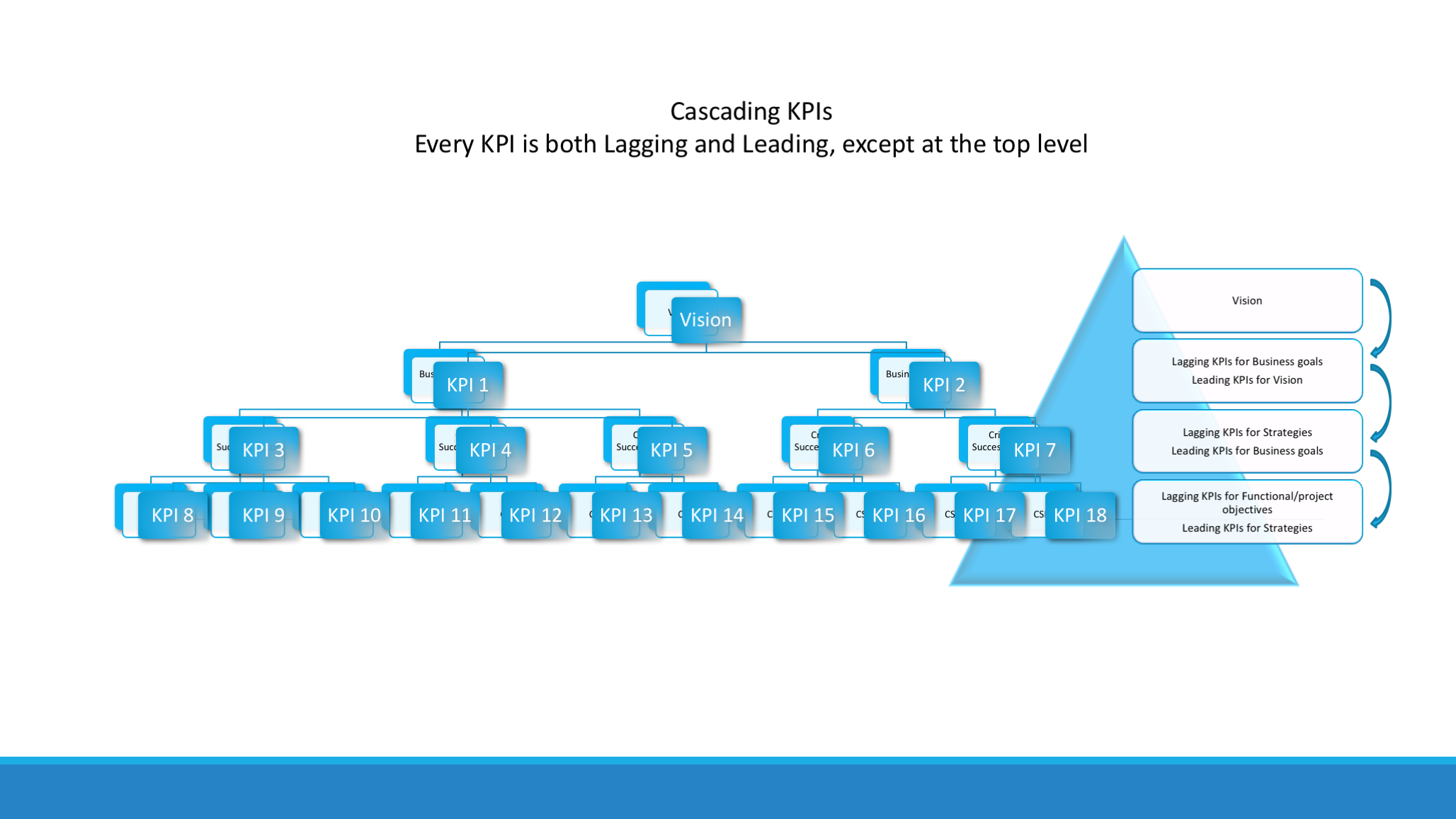

Well, the key, I think, strange as it may seem, is to go back to what I was saying about leading and lagging indicators. The lightbulb will come on if you realise that the same measure can be both a leading and a lagging indicator. We saw, above, that website visitors can be a leading or lagging indicator.

The thing that differentiates whether a measure is a leading or lagging indicator is the performance objective that you want to measure.

And this where you start to see the link to business strategy.

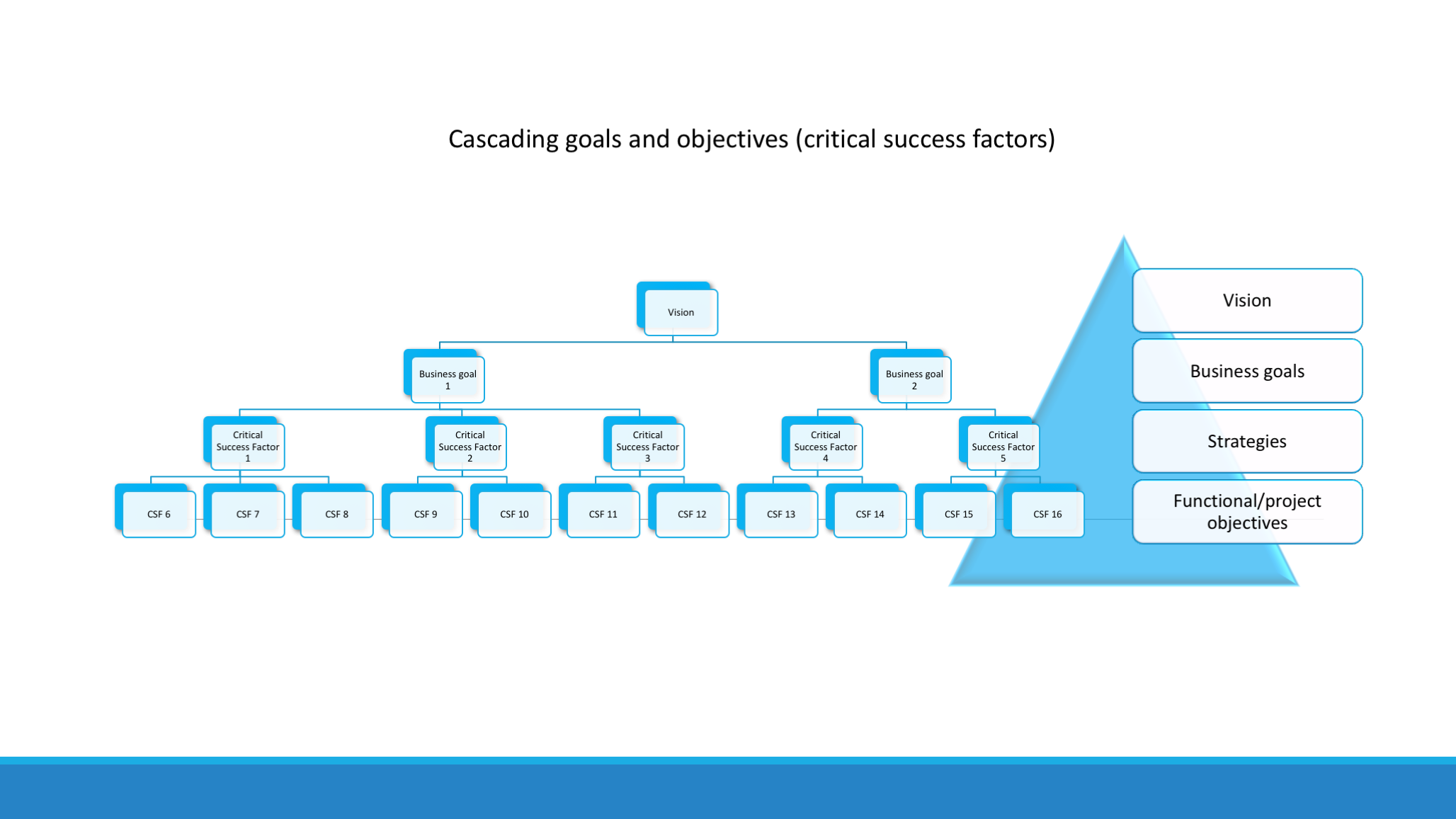

We can see business strategy as a series of cascading objectives flowing from the overall business vision and top level goals. Think of it like this:

For your top level business goals: “In order to <insert goal> we need to <do/achieve X and Y and Z>”.

Each of the <do/achieve X/Y/Z> are themselves goals or objectives… for which you can then do the same thing.

In that way, the business goals flow down to strategies, which flow down to functional and project objectives, which then flow down into team objectives. Each of those objectives is a “critical success factor” for the next level objective.

Step 2 to develop KPIs - The questions to shape the measures

Once you’ve mapped out the logical flow of objectives, what you have done is to make the purpose clear for each critical success factor.

Each critical success factor (or objective) then needs an indicator or measure (you know that objectives should be SMART, right?).

So, for each of the objectives, ask the following questions:

- What does good performance look like?

- What are the simplest ways to tell how well we’re doing towards that objective?

- What actions and behaviours are most appropriate to improve performance? What metrics will influence behaviour in the right way?

Targeting

I think that following the above process helps you to avoid selecting irrelevant measures as KPIs, because it keeps you thinking strategically. Everything flows from the business vision and goals, and therefore every critical success factor has a purpose. So, all the measures for them (after asking the right questions) will be key performance indicators.

Hopefully that’s all helpful. But what about targets? A KPI is just a measure. Do we need targets for our KPIs, to define or inform “what good looks like?”

Quite often, yes. And probably most of the time the target is embedded in the objective (critical success factor). The target is kind of integral to the concept of ‘what good looks like’. But not always. And target setting (and the incentives that are so often linked to them) involves some big questions, because of the behaviour-driving consequences. I don’t think many managers realise how big these questions are. Targets and bonuses and incentives are the norm, so why question the situation? I offer four brief reflections in closing:

- People are often incentivised by simple measurement, with no targets whatsoever – if it’s clear what constitutes good performance, and it’s easy to measure, then very often people will just try to improve it month after month, and year after year. They don’t need a ‘bribe’. The psychology is that if I’ve been employed to do a job, and I’m told what constitutes a good job, then I’ll do whatever is necessary to do that.

- Everyone’s psychology is different – some need more incentives than others. That makes the effectiveness of incentives and targets (if used with the intention of encouraging certain behaviour) unpredictable, to an extent.

- We need to understand why we are targeting – for incentivising people or for planning purposes. Targets and incentives are not necessarily the same thing. Targeting something doesn’t have to carry incentives with it. Sometimes you need a target just for planning purposes – e.g. we may have to make a planning assumption for ‘sales conversion’. It may not be a target, but it’s still a KPI, because it’s critical to our objective of increasing sales. There’s a big difference. Targets for incentives should be stretching. ‘Targets’ for planning purposes are more like mere forecast KPIs, and should be conservative.

- Targets used are often far too arbitrary – we should be looking for established benchmarks and relative targets more. When we’re thinking about ‘what good looks like’, for common standard activities there may be standard benchmarks. Where things are unique to your business, rather than ‘what is good’, you may have to ask ‘what is better’ – better than last year/month, better than the other sales teams, etc.

Free Download - KPI Healthcheck Bundle

To help you further, I've developed a questionnaire that can help you to assess whether your KPIs are fit for purpose, using the concepts I've outlined in this article.

You can get hold of the KPI Healthcheck Bundle by clicking here.

Summary

I hope that has been helpful. Developing Key Performance Indicators (KPIs) is something that a lot of people struggle with. The key thing, I would argue, is to the think in terms of cascading objectives down out of the business strategy.

Related articles

Business Performance Management for Finance Professionals

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates on new resources to help you make your Finance role add value in the business you work for

[Your information will not be shared with external parties for anything other than the provision of Supercharged Finance products and services.]